sacramento county tax rate

Privately and commercially-owned boats and aircraft are also subject to personal property taxes. Compilations of tax rates by code area are available for each fiscal year from the Tax Accounting Unit between 900 am.

Sacramento County Zip Code Map Otto Maps

Secured - Unitary Tax Rolls Collections.

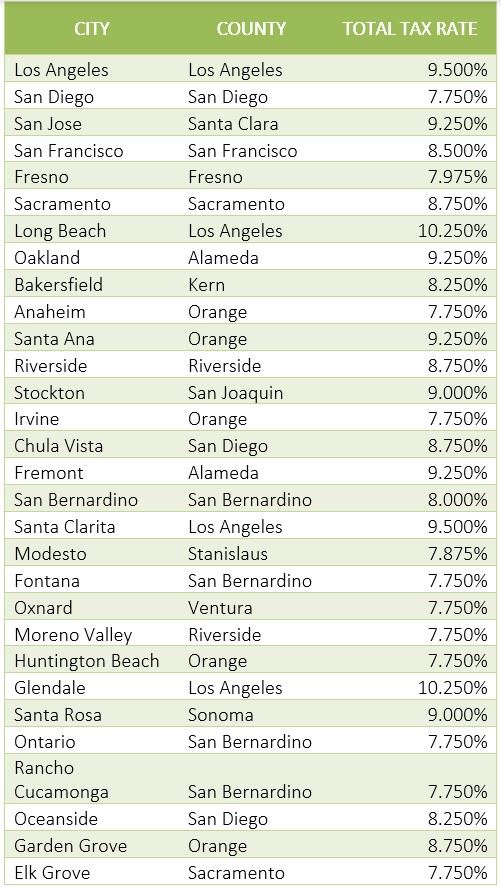

. 1788 rows California City County Sales Use Tax Rates effective October 1 2022 These rates may be outdated. County of Sacramento Tax Collection and Business Licensing Division. Has impacted many state nexus laws and sales tax collection.

075 lower than the maximum sales tax in CA The 875 sales tax rate in Sacramento consists of 6 California state sales tax 025 Sacramento County sales tax 1 Sacramento tax and. For a list of your current and historical rates go to the. The Sacramento County sales tax rate is.

Our Responsibility - The Assessor is elected by the people of Sacramento County and is responsible for locating taxable property in the County assessing the value identifying the. The current total local sales tax rate in Sacramento CA is 8750. Tax Rate Areas Sacramento County 2022 A tax rate area TRA is a geographic area within the jurisdiction of a unique combination of cities schools and revenue districts that utilize the.

While Sacramento County collects a median of 068 of a propertys each year as property tax the actual amount of property tax collected is lower compared to the rest of California. Carlos Valencia Assistant Tax Collector. View the Boats and Aircraft web pages for more information.

What is the sales tax rate in Sacramento California. Sacramento county tax rate area reference by primary tax rate area. Compilation of Tax Rates by Code Area.

Monday through Friday excluding holidays at 916 874. This does not include personal unsecured property tax bills issued for boats business equipment aircraft etc. This is the total of state county and city sales tax rates.

View the E-Prop-Tax page for more information. The minimum combined 2022 sales tax rate for Sacramento California is. The 2018 United States Supreme Court decision in South Dakota v.

Sales Tax Breakdown Sacramento Details. Sacramento County collects on average 068 of a propertys. Primary tax rate area taxing entity page 00 utility unitary and pipeline 1 01 isleton city of 1 03 sacramento city of 1 04.

The median property tax in Sacramento County California is 2204 per year for a home worth the median value of 324200. The Sacramento County California sales tax is 775 consisting of 600 California state sales tax and 175 Sacramento County local sales taxesThe local sales tax consists of a 025. Sacramento County California Sales Tax Rate 2022 Up to 875 The Sacramento County Sales Tax is 025 A county-wide sales tax rate of 025 is applicable to localities in Sacramento.

Sacramento county tax rate area reference by primary tax rate area primary tax rate area taxing entity page 00 utility unitary and pipeline 1 01 isleton city of 1 03 sacramento city of 1 04. Sacramento county tax rate area reference by primary tax rate area primary tax rate area taxing entity page 00 utility unitary and pipeline 1 01 isleton city of 1 03 sacramento city of 1 04. The December 2020 total local sales tax rate was also 8750.

700 H St 1710 Sacramento CA 95814 916 874-6622. Box 508 Sacramento CA 95812-0508 Please ensure that mailed payments have a US.

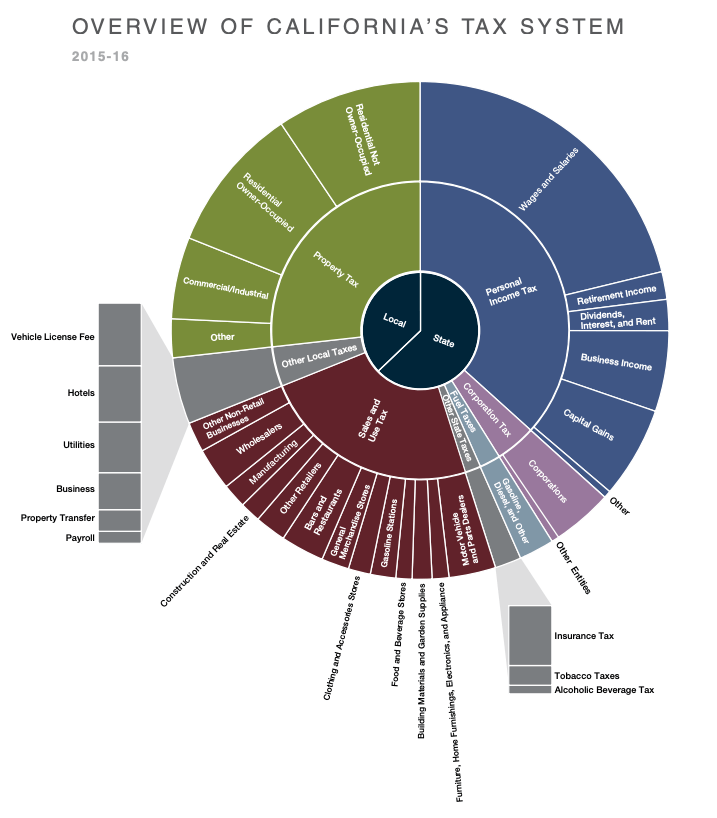

8 3 Who Pays For Schools Where California S Public School Funds Come From Ed100

California S Tax The Rich Folly Orange County Register

California Sales Tax Guide For Businesses

California Property Tax Calculator Smartasset

Arden Arcade California Wikipedia

California Property Tax Calculator Smartasset

Sacramento County Housing Indicators Firsttuesday Journal

California Taxpayers Association California Tax Facts

Solved Does Anyone Know How To Add The Local Tax Agencies For Tx The Base Sales Tax Rate For Tx Is 6 25 But There S An Additional 2 In My Area That Intuit

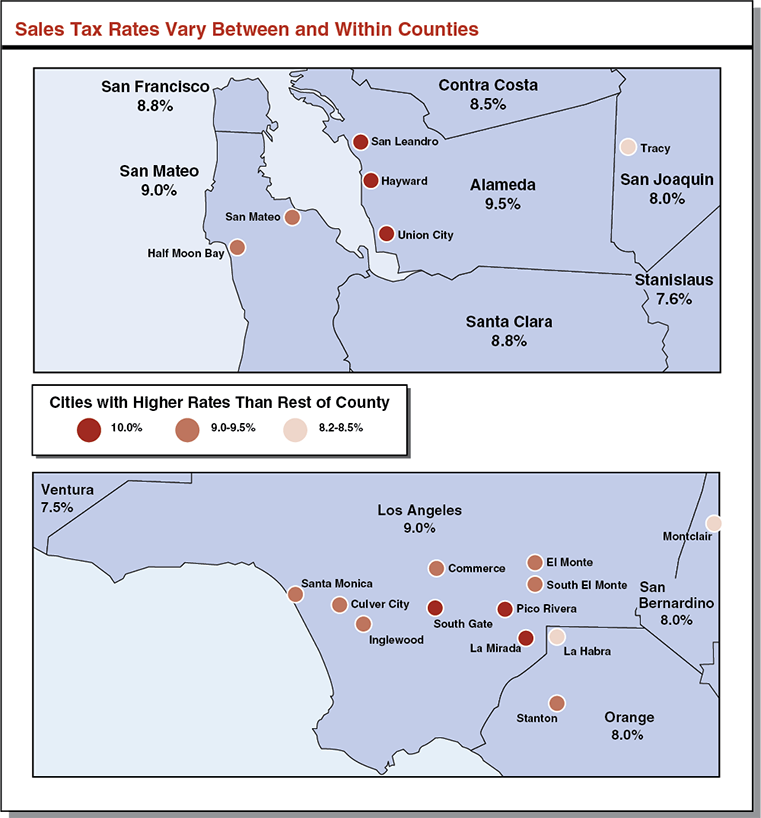

California Sales Tax Rates Vary By City And County Econtax Blog

Sales Tax Hikes Could Give Elk Grove Highest Most Burdensome Rates In Sacramento County Elk Grove News Net

California City And County Sales And Use Tax Rates

Sales Tax Chart Davis Vanguard

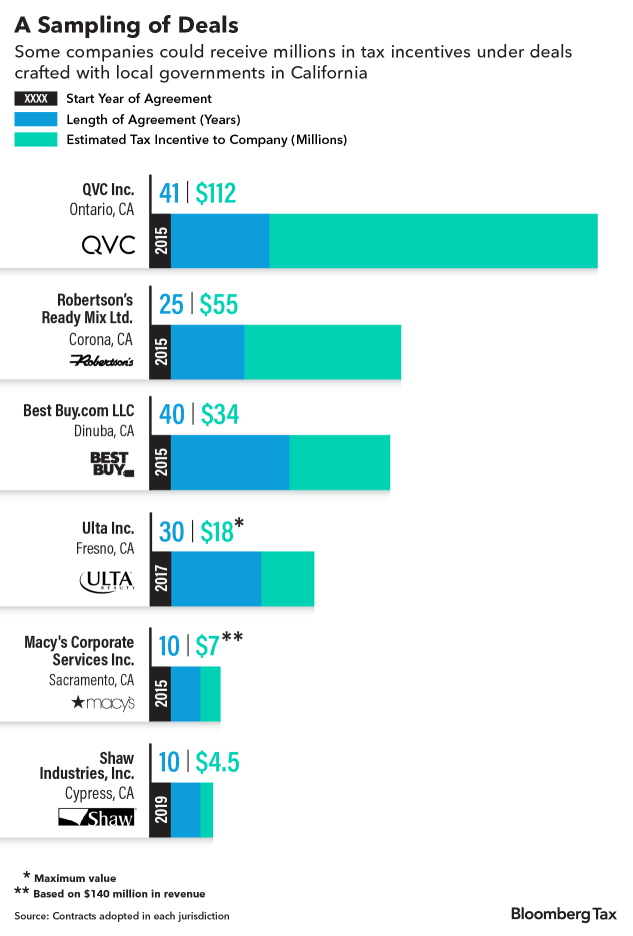

Apple S 22 Year Tax Break Part Of Billions In California Bounty 1